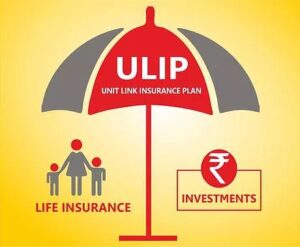

A ULIP (Unit Linked Insurance Plan) is a financial product offered by insurance companies that combines:

It is one of the most popular investment options for long-term goals like wealth creation, child education, retirement, and financial security.

When you pay a premium (monthly/yearly):

This protects your family financially if something happens to you.

You can choose:

Equity Funds (high growth, high risk)

Debt Funds (stable, low risk)

Balanced/Hybrid Funds (mix of both)

The value of your investment grows based on market performance.

You get:

Life insurance cover

Investment returns

One plan serves two purposes.

You can switch your money between:

Equity

Debt

Balanced funds

This helps you manage risk and take advantage of market movements.

Most insurers allow a certain number of free switches per year.

ULIPs are designed for long-term goals (10–20 years).

The longer you stay invested, the more your money grows.

ULIPs have a 5-year lock-in period.

This encourages disciplined long-term saving.

You can track:

Fund value

NAV (Net Asset Value)

Charges

Investment performance

Everything is shown clearly in your policy statements.

You may get:

Tax deductions on premiums

Tax-free maturity benefits

Tax laws vary by region, but ULIPs are usually tax-efficient.

For example:

If your sum assured is $50,000, your family receives this if you pass away.

Your remaining premium is invested to grow your wealth.

Invest in stock markets

High return potential

Higher risk

Invest in bonds and securities

Lower risk

Stable returns

Combination of equity + debt

Moderate risk

Ideal for most investors

Very low risk

Suitable for short-term needs

You can select or change funds anytime.

ULIPs are ideal for goals such as:

Pick a ULIP if you want investment + insurance in one plan.

ULIPs have some charges, typically:

Fund management charges

Mortality charges (for insurance cover)

Policy administration charges

Switching charges (mostly free)

These are deducted from your fund value and are disclosed upfront.

Let’s say you invest 1,00,000 per year for 15 years.

20,000 goes toward life insurance

80,000 goes into investment funds

If your investment grows at 8% per year, you may get a large corpus at maturity

Meanwhile, your family is protected with life insurance throughout the policy.

| Feature | ULIP | Traditional Insurance | Mutual Funds |

|---|---|---|---|

| Insurance + Investment | ✔ Yes | ✔ Mostly Insurance | ✖ No |

| Market-linked returns | ✔ Yes | ✖ No | ✔ Yes |

| Flexibility to switch funds | ✔ Yes | ✖ No | ✖ No |

| Lock-in | 5 years | Usually long-term | No lock-in |

| Transparency | High | Low | High |

ULIPs offer flexibility + protection, which neither traditional plans nor pure mutual funds provide.

ULIPs are suitable if you:

Want long-term growth

Want both insurance & investment in one plan

Are okay with market-linked returns

Want flexibility to switch funds

Want tax benefits